June 2023 monthly investment news

May was dominated by discourse surrounding the US debt ceiling as Republicans and Democrats in the US struggled to reach an agreement, writes Richard Temperley.

The US treasury had warned of potentially disastrous economic outcomes if an agreement wasn’t made by early June. However, despite the narrative, global equities moved higher once again. Inflation concerns also made their way back to the fore in May as US Core PCE inflation (the Fed’s preferred measure) ticked up to an annualised rate of 4.7% from 4.6%.

Yields rose steadily with the Benchmark US 10 Year Treasury yield ending the month at 3.64%. Central bank policy is likely to diverge further from this point.

News of Q1 GDP results also influenced sentiment as the US figure for the first quarter of 2023 displayed a slowing economy. GDP came in at 1.1%; down from the previous figure of 2.6%. In Europe, fears of an economic slowdown also persisted.

Germany, Europe’s largest economy, saw GDP revised downwards for Q1 displaying a contraction in economy activity. Towards the end of May the final figure was revised from 0.0% to -0.3% seeing the country enter a technical recession.

Activity

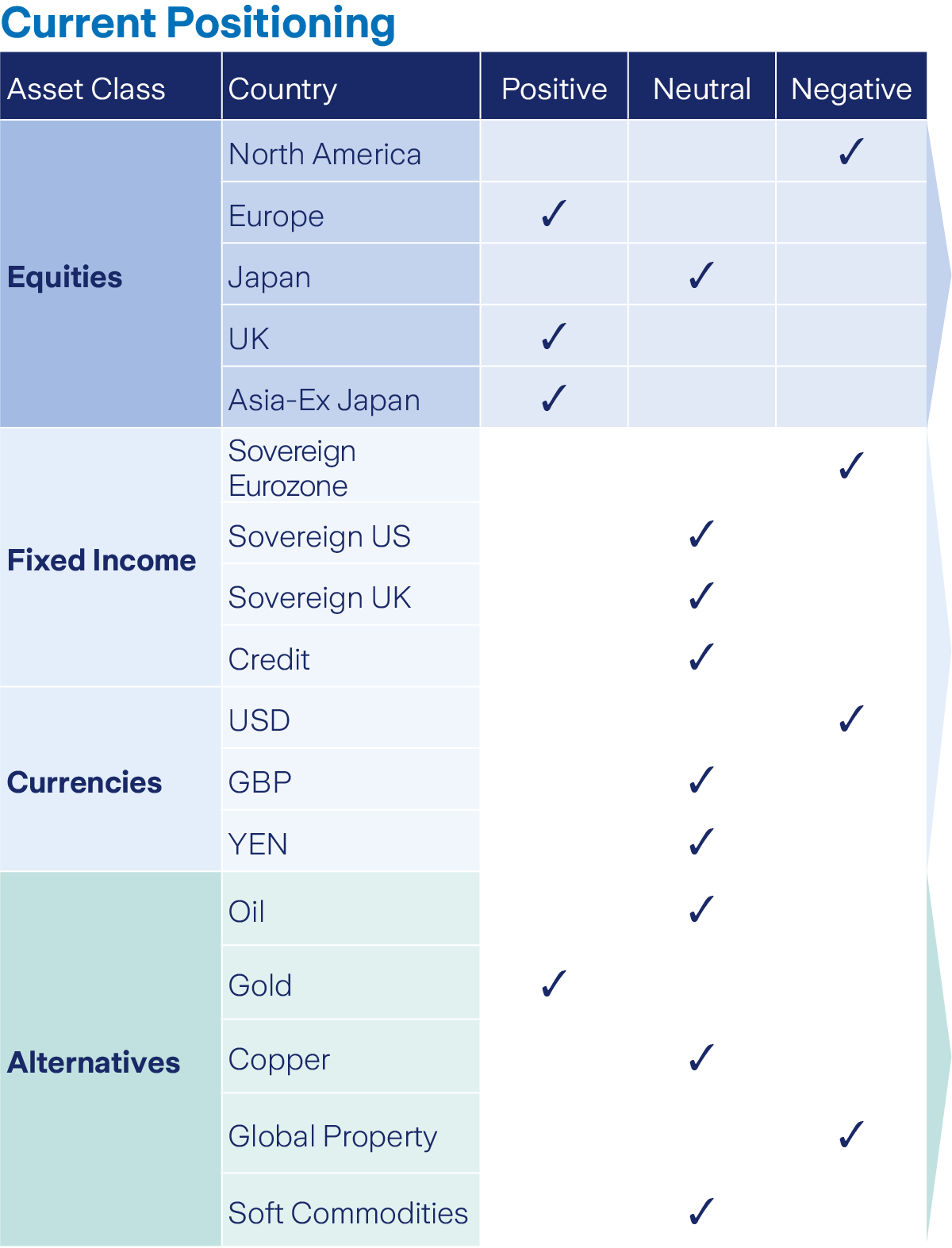

At Zurich, we remain positive on equities. We have added to our equity allocation several times this year and global stocks are now trading close to their year-to-date highs, which has been beneficial to our performance.

A number of economic indicators such as earnings and jobs growth have surprised to the upside in recent weeks along with lower inflation figures despite weak sentiment surveys. Equities have begun to reflect this through higher returns.

Our positioning and purchases during times of lower valuations has proven to be advantageous. We are neutral in our absolute allocations to both sovereign and corporate bonds but have added to the duration within those exposures. We maintain our EUR/USD hedge which has contributed to performance in 2023.

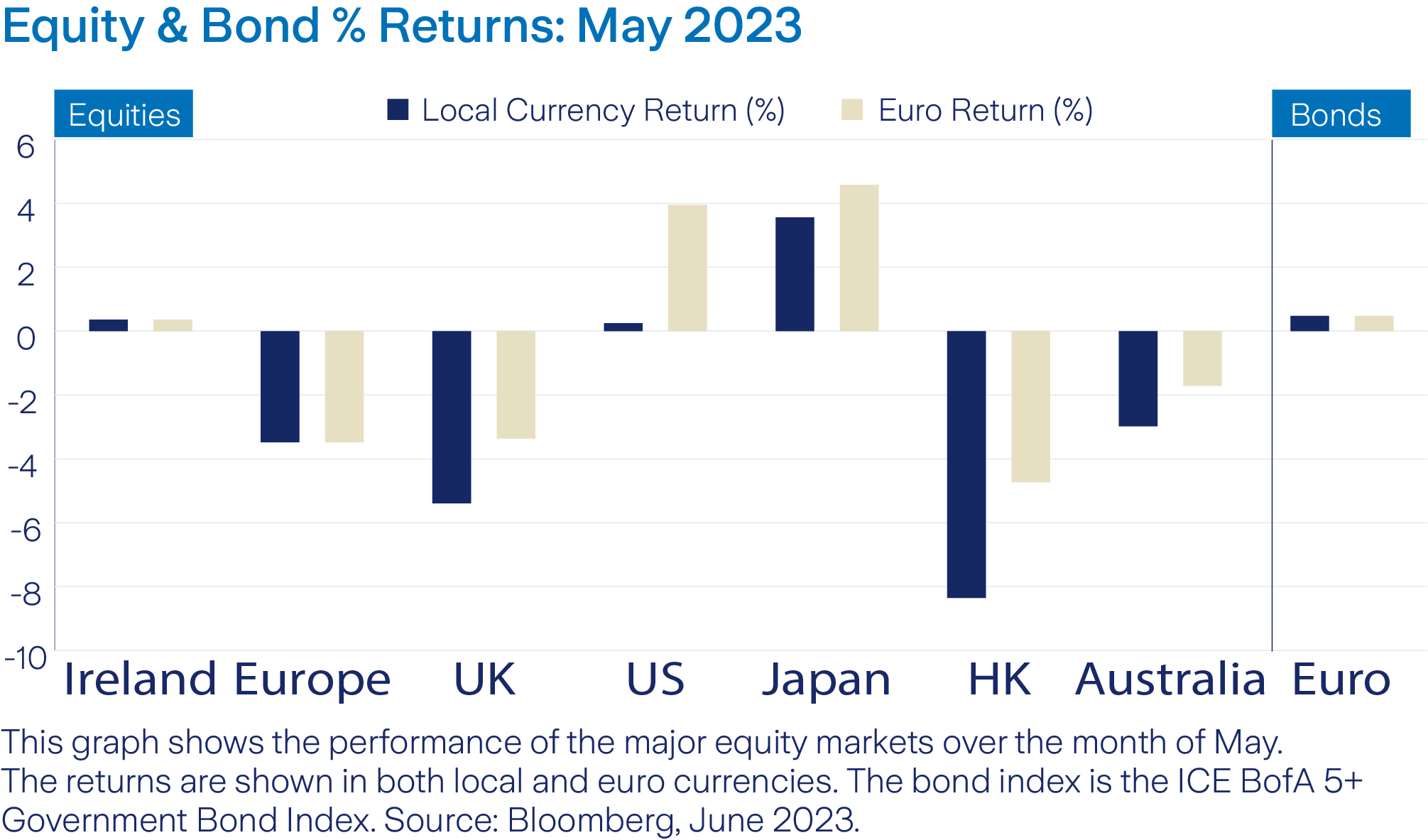

Equity markets

May’s best performing major market in Euro terms was Japan, returning 4.6%. Japan has seen capital inflows in the last number of weeks as sentiment improves due to changing monetary policy and increased levels of shareholder activism.

Hong Kong equities on the other hand lost -4.7% in Euro terms last month as China fails to meet growth expectations following its post covid reopening.

On a global sector basis, information technology stocks performed best, returning 12.2% in Euro terms in May. Declining interest rate expectations and positive sentiment to AI developments, has made growth stocks more attractive.

US sectors largely mirrored global performance with Energy performing worst as prices continue to lower.

Bonds & interest rates

Eurozone bonds were up slightly in May, whilst the US ten year treasury fell on a price basis. US yields rose steadily throughout the month, particularly due to fears of a government default when negotiations on raising the debt ceiling became tentative. This largely reversed towards the end of the month when news of a likely agreement in Washington mollified investors.

The benchmark European 5+ Year bond index returned 0.48% in May. The Federal Reserve and ECB raised interest rates by 25 basis points each in May which was as expected. Peak inflation and lower interest rate expectations has meant there is a cautious optimism emerging in this area.

Commodities & currencies

May was another volatile month for commodities with many components entering negative territory. Energy-related commodities suffered the most as prices have declined, and demand begins to taper off somewhat.

Industrial metals also felt the burden of decreased demand following indications that the global economic outlook has slowed. Copper, often viewed as a barometer for global economic health, returned -3.9% in Euro terms. Meanwhile Gold made positive returns, gaining 8.4% in May. Gold which has historically had a negative correlation with interest rates, has benefitted from softer policy expectations surrounding the Federal Reserve. At the end of May one Euro purchased 1.069 US Dollars.

Warning: Past performance is not a reliable guide to future performance.

Warning: Benefits may be affected by changes in currency exchange rates.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in these products you may lose some or all of the money you invest.