Understanding the different types of pensions, whether it’s a personal, occupational, or State pension, can be difficult. Furthermore, every type of pension has different pension schemes. With this guide, we want to make it easy to understand what a pension is, how it works and why you should consider a private pension if you don’t have one already.

Zurich has been meeting the financial needs of people in Ireland for over 40 years. Our award-winning* investment team, in Dublin, is responsible for funds under management of approximately €38 billion, of which pension assets amount to €32.8 billion**.

Table of contents:

What is a pension?

A pension scheme (or pension plan) is a long-term savings plan that helps you save for your future retirement. A pension plan allows you to make regular payments and/or transfer one-off lump sums into a fund for retirement. The amounts saved into your pension are called ‘contributions’.

How do pensions work?

Each payday, each year or as often as you like, you save some money into a retirement fund. Your fund is put away and invested. Its aim is to grow over time, so that when you finally decide to retire, you'll have savings to live out your life with a good income - happily. That's it. A pension is just a way of saving for the long-term. But it's different for two reasons – tax and time.

What are the main types of pension plans in Ireland?

Occupational pension schemes

Occupational pension schemes usually involve both employee and employer contributions. These schemes are mostly for private sector workers but include funded schemes set up by commercial entities too.

Learn more about occupational pensions for employers and employees available at Zurich.

Personal pensions (also known as private pensions)

Personal pensions are individual savings contracts designed to provide retirement benefits, which include a Personal Retirement Savings Account (PRSA), an Annuity and Personal Retirement Bond.

Some of the most popular pension plans are:

Personal pension scheme:

A personal pension is suitable for self-employed and employees whose employer does not offer an occupational pension. Learn more about personal pensions.

Personal Retirement Savings Account (PRSA):

A flexible and portable retirement savings account you can bring with you when you change job. Learn more about PRSAs.

Personal Retirement Bond (PRB):

With a PRB, when you leave a pension scheme, the value of your fund is invested in a bond which you can benefit from at retirement. Learn more about PRBs.

Executive pension:

This is a pension plan designed for company owners and directors. This option is ideal for you and your employer to make tax-free contributions and if you want to take a tax-free cash lump sum – depending on length of service, salary and fund size – you can. Learn more about executive pension plans.

Additional Voluntary Contributions (AVCs):

AVCs are extra contributions you can make alongside your existing pension plan to increase your pension fund. Before you decide on an AVC you should first find out what you will be entitled to when you retire. Learn more about AVCs.

If you are unsure about what pension scheme you may need, you can consult a Zurich financial advisor for professional advice before choosing a pension. We have also provided some information on different pensions in our guide to choose a pension plan with Zurich.

Contributory State pension

Learn more about the Irish State pensions.

Public service pensions

State pension or private pension? Why it makes sense to have both

Before deciding whether to start a private pension, it may be worth exploring whether your employer offers an occupational pension scheme.

Listen to Zurich’s 60-second explainer on why you should start a pension.

What are the benefits of a personal pension?

Live the life you want at retirement

Today, the State pension (contributory) in Ireland is worth €277.30 per week. We can't predict what will happen, but we do know that starting a pension can give you greater ownership of your future. Putting a little aside today could help you live an active and productive retirement tomorrow.

Tax relief on pension contributions

Unlike a regular savings account, money invested in your pension can earn important tax breaks.

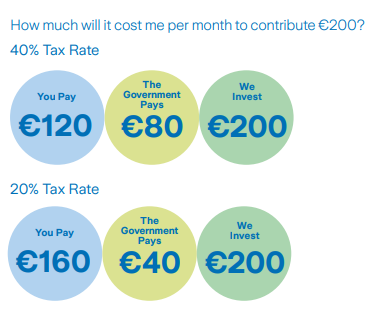

Tax relief on your pension is based on the rate of income tax that you pay, this will be 40% for a higher rate taxpayer or 20% for a standard rate taxpayer. For example, putting €200 into a regular savings policy will cost you €200 but putting the same amount into a pension will cost you €160 if you are a standard rate taxpayer or €120 if you are a higher rate taxpayer.

And when you retire and look for access to your fund, the benefits of your pension can be available in a tax efficient way. Try our personal pension tax relief calculator to see the tax benefits available to you.

Let the compound effect grow your retirement savings

Any returns on your investment are re-invested over and over, for years. It all depends on how your investment performs, but even a small amount of savings in a pension when you are young could become much larger by the time you retire.

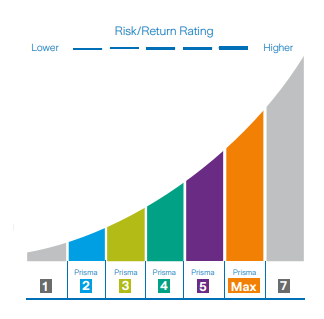

You are in control

You can decide how your pension is invested. We have a range of investment funds suitable for different levels of risk. Our Prisma Fund range are funds targeted to different attitudes to risk, from low to high, so whatever your appetite for risk, there is likely to be a fund to suit you.

It is never too late to start

These days we are living longer than previous generations. In fact, most of us can now look forward to 20 or even 30 years in retirement. A pension can help you plan for these years, whether you want to retire to the country, travel, or spend time with your grandchildren.

Why you should start a pension

Kristen Foran, Zurich National Sales Director, explains why it is never too late to start saving for retirement in the following 60 seconds video.

How to start a pension?

As mentioned, it’s never too late to start a pension. At Zurich we have all the tools you need to make an informed decision on your pension and future financial planning.

- Our pension calculator can help you visualise how much you could have in your pension when you retire.

- Get a free consultation with our financial planners. They will help you understand what the best pension plan is for your needs, the type of investment you are willing to make and the options you have to receive your pension at retirement.

- Alternatively, you can find an external financial advisor by using our find an advisor tool.

You can find a more detailed step-by-step process on how to start a pension here.

Benefits that come with Zurich

Innovative investment solutions

Equities, bonds, property, money markets, commodities… investing often comes with an array of choices. Even when you’ve chosen a route that matches your circumstances, needs and feelings about risk, you must keep a close eye on your portfolio to ensure your investments continue to meet your financial goals, particularly as your life changes. If you don’t have the time or desire to dive into the complex world of investments yourself, the innovative Prisma Fund range are designed to reflect a range of risk levels to suit your circumstances.

Online Access

With a Zurich pension you’ll have the opportunity to keep track of your investment at the click of a button. With 24hr access to Zurich’s Client Centre, whether you’re interested in every market movement or would rather check in once a year – Zurich makes this easy to do. Our online Client Centre also has plenty of handy tools to help you plan for your future. These include calculators to help you work out your budget, how much you can contribute into a pension, and a tool that works out what tax relief is available.

A trusted pension partner

Zurich is one of Ireland’s most successful life insurance companies***. Based in Blackrock, Co. Dublin, we have been meeting our customers’ needs in Ireland for over 40 years. Pensions form a huge part of what we do, with thousands of Irish people trusting us to manage their retirement fund. In fact, our investment team is responsible for pension funds under management of approximately €32.8 billion**.

Keep learning about pensions

Read more from our financial wellbeing blog

Everything you need to know about pension contributions

Whether you are self-employed or already in a company pension scheme or in non-pensionable employment, the need to save for a pension for your retirement is abundantly clear. So, in this article we are just going to focus on the tax saving benefits which are available from the government to encourage people to plan for their retirement – and hopefully demonstrate why pensions are the most tax efficient form of savings around.

Pension top ups and tax benefits explained

Did you know you can top up your pension and benefit from tax relief in the process? Planning for your future has never been more important. This article was first published on thejournal.ie.

PRSA 2023 changes: The impact on the pensions landscape

Sources:

*Investment Provider Excellence Award, Brokers Ireland, 2022; Pension Provider Excellence Award, Brokers Ireland, 2023.

**Zurich as at 30th June 2024.

***Financial Services Company of the Year, InBUSINESS Recognition Awards, 2023.

The information contained herein is based on Zurich's understanding of current Revenue practice as at 1 March 2024 and may change in the future.