The Cost of Secondary School Education 2023

Children in Ireland are entitled to free education, but each year back-to-school costs are rising for families. The Zurich Cost of Education Survey 2023* highlights the increasing cost of secondary school in Ireland. Here's a list of expenses you can expect to pay each year and the lifetime cost of putting just one child through secondary education.

The cost of putting just one child through school can easily run into tens of thousands of euro. If you have two or more children then you're going to have to dig even deeper to sustain the cost of their educational needs over the long-term.

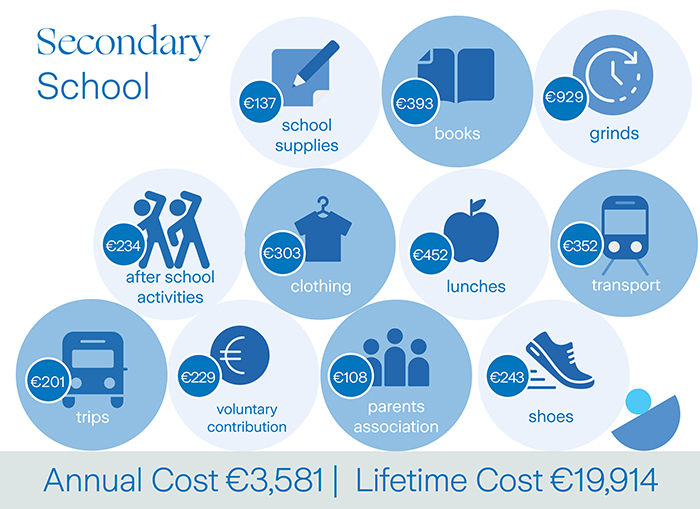

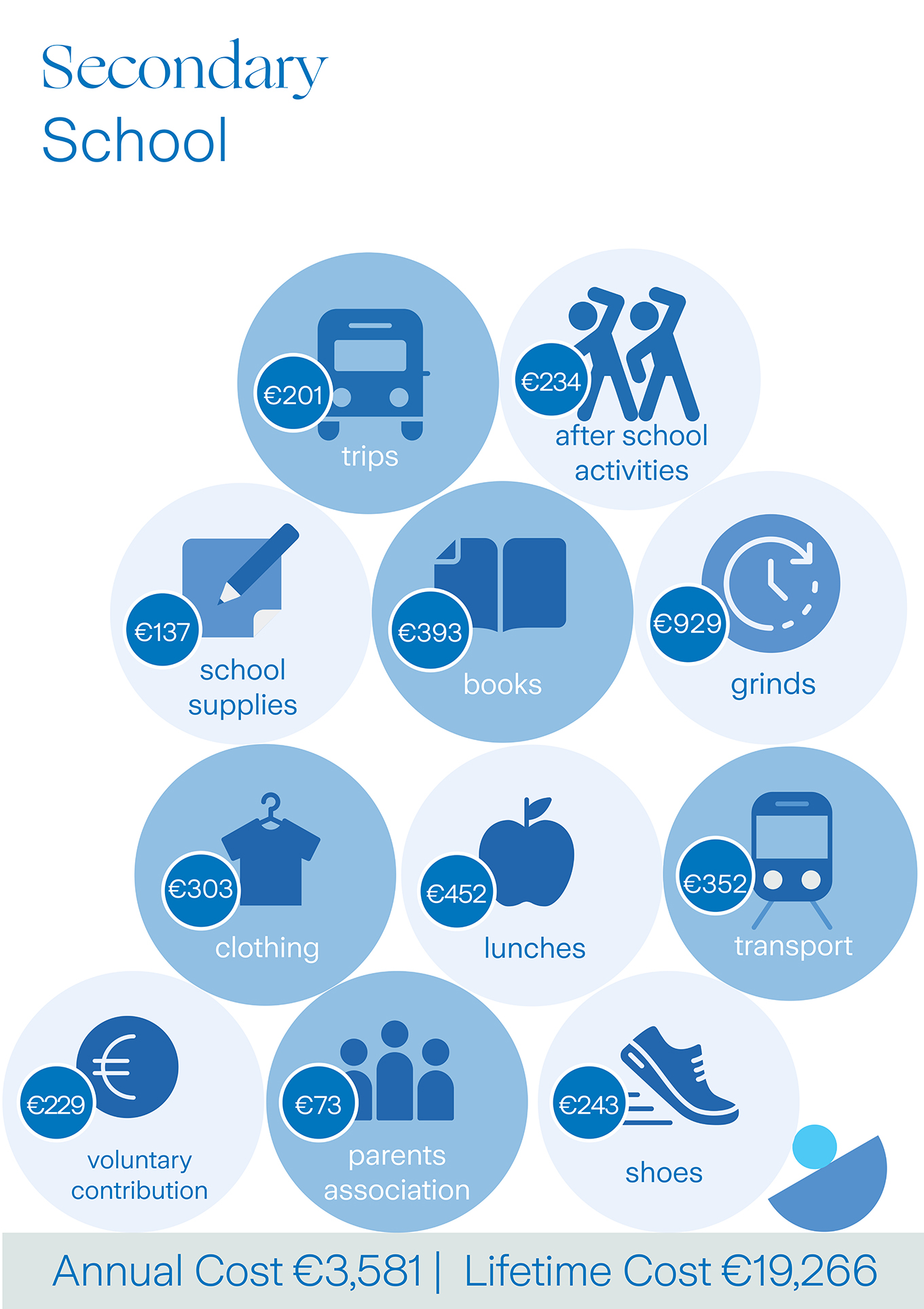

The Zurich Cost of Education Survey 2023* has revealed the cost of educating your children in Ireland, and details what you can expect to spend throughout your child's school and college years. The average annual cost of education for a child entering first year is €3,581; an increase of €763 compared to last year*.

According to our research, grinds are the most sizeable expense, costing on average €929 per child. The move to secondary school also brings a greater number of 'other' expenses such as lunches (€452), books (€393), transport (€352) and clothing (€303).

Our research into the cost of secondary school also reveals that parents underestimate the cost of secondary school believing it to be €2,531 for one child per school year. However, our study uncovers that the cost is much higher at €3,581. If we allow for the fact that the bulk of school books will be bought in first and fifth year in the build-up to junior cert and leaving cert cycles respectively, the total cost of six years' secondary school education, extra expenses excluded, is estimated to be €19,914.

The Cost of Secondary School Education

| Item | Estimated Cost |

|---|---|

| Grinds | €929 |

| Lunches |

€452 |

| Books |

€393 |

| Transport |

€352 |

| Clothing |

€303 |

| After school activities |

€234 |

| Shoes |

€243 |

| Voluntary contribution |

€229 |

| Trips | €201 |

| School supplies | €137 |

| Parents association | €108 |

| Annual cost | €3,581 |

| Lifetime cost |

€19,914 |

Adding it all up

For parents with children in secondary school, finding the money each year for school items can put a strain on their finances. To alleviate some of these financial burdens, parents are constantly looking at ways to reduce their children's school costs. However, there are many expenses such as uniforms, books, and voluntary contributions that are unavoidable.

An example of this is in relation to school books. For 59% of secondary school children, they are primarily required to have hard copies of books and the Zurich Cost of Education research report found that 50% of secondary school children were offered a book rental scheme.

Parent's looking at reducing the cost of books during the post primary cycle said that the use of technology could have an impact here. In secondary school, parents said they would like to see more widespread use of laptops, iPads and eReaders in their children's classroom.

Similarly with regard to uniforms, parents can try to reduce the cost by providing non-branded uniforms for their children but this is dependent on the policy of individual schools. During our research into the cost of education in Ireland, we found that 58% of secondary school children have to wear a full branded uniform.

There are other areas where parents can reduce costs such as lunches and transport. Secondary school children can bring a packed lunch, but for those that buy their lunch or eat in the school canteen the average spend on school lunches in the year is €452. In secondary school, transport costs for the academic year average around €352 but if children can walk or bike to school then this will eliminate the transport cost.

Early life saving

There are some measures parents can take to reduce the cost of sending their children to secondary school, such as providing packed lunches, walking to school and availing of book rental schemes. Other solutions to minimising the financial burden of children's education is early planning and financial saving.

Looking specifically at parents' saving behaviour, the Zurich Cost of Education research found that parents that have a savings account say their top saving priority is to cover their children's education costs.

*Source: Zurich Cost of Education Survey 2023

Something to think about...

It's clear to see that the cost of education is high and increases over the years. So, wouldn't it make sense to plan ahead and build up your savings year-on-year?

With a Regular Savings plan you can gradually build up the funds necessary to support your children's education.

The table below illustrates just how much regular savings can grow with a Zurich LifeSave Savings Plus plan. For example, if you saved the Government child benefit of €140 per month for five years (as of July 2023) from when your child was born, by the time they started school you could have built up savings of €8,784 in time to fund this crucial stage in their education.

| Savings fund after five years starting primary school | Savings fund after 12 years starting primary school | |

|---|---|---|

| Regular contributions of €140 per month* | €8,784 |

€22,589 |

| Lump sum of €10,000 and regular contributions of €140 per month* | €19,749 | €35,159 |

|

A gross investment return of 4.6% per annum is assumed for the 5 year savings fund and 4.6% per annum for the 12 year savings fund. We have assumed that on death, encashment, partial encashment or assignment of the policy or on each 8th policy anniversary, tax is deduced on the gains made at the current rate of taxation, being 41%. A government insurance levy (currently 1% as at July 2023 and may change in the future) applies to this policy. The contribution amounts above are inclusive of this levy. No surrender penalties apply. An annual management charge of 1.35% and an allocation rate of 101% apply. The information contained herein is based on Zurich Life's understanding of current Revenue practice as of July 2023 and may change in the future. |

||

Cost of education calculators

Our Cost of Secondary School Calculator is a tool that helps you work out how much you need to save to cover the costs of putting children through secondary school.

Cost of Secondary School Calculator

Use our Cost of College Education Calculator to work out the estimated costs of sending your children to college and to see how much you might need to save each month to meet these college costs.

Benchmark Tool

Use Zurich's Cost of Education benchmarking tool to see how education costs compare and pinpoint where savings could be made.

Voice services

When it comes to planning your future, saving is a great place to start. Whatever your goals are, saving with Zurich is a smart move. Whether using Google Assistant or Amazon Alexa, the Zurich Ireland voice services action offers you multiple savings calculators to help plan and save for the future.