The Cost of College Education in Ireland 2025

If you're planning to support your children when they reach university, it might be wise to start saving now. The 2025 Zurich Cost of Education Survey1 reveals the staggering costs for college students living at home and in rented or student accommodation.

Source: 1Zurich Cost of Education Survey 2025

If you're planning to support your children when they reach university, it might be wise to start saving now. The Zurich Cost of Education research reveals the costs for college students living at home and in rented or student accommodation.

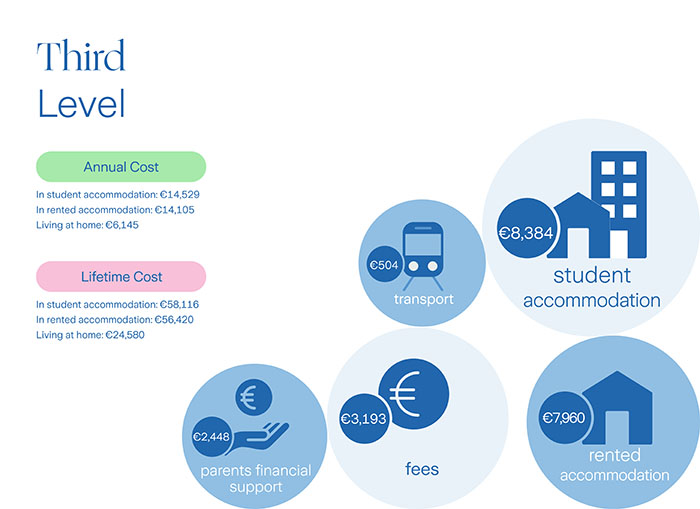

The majority (57%) of students studying at third level education, currently live at home which comes as no surprise given the high cost for accommodation for students. The average annual cost of student accommodation for students in third level education was €8,384 and rented accommodation had an average annual cost of €7,960.

Parents of third level students estimated it costs them €9,293 to send their child to third level. Although the cost per child for those living at home is €6,145, if a child is in student or rented accommodation, the costs are likely to be much higher as illustrated above.

The most popular modes of transport for third level students when travelling to and from college is public transport (62%) and by car (27%). The average cost is €504, down €46 from 2024.

When asked if parents support their child financially outside of rent, transport and college fees, 67% of parents said they do provide financial support to their child in third level. The average monthly financial support parents provide is €272, which is approximately €2,448 for the duration of the academic year (9 months).

Nearly half of all parents surveyed think their child is under financial strain in college. A part-time job is the top way that third level students mitigate against financial strain with 63% of parents stating that their child has a job as well as attending college.

A breakdown of third level education costs*

| Item | Estimated Cost |

|---|---|

| Student accommodation | €8,384 |

| Rented accommodation | €7,960 |

| Fees | €3,193 |

| Parents financial support |

€2,448 |

| Transport |

€504 |

| Annual Cost | |

| With student accommodation | €14,529 |

| With rented accommodation | €14,105 |

| Living at home | €6,145 |

| Lifetime Cost | |

| With student accommodation | €58,116 |

| With rented accommodation | €56,420 |

| Living at home | €24,580 |

Building up funds

A great education is the best possible start in life and for most parents ensuring they can provide for their children's education, from primary school right through to third level, is crucial. Our Cost of Education research clearly shows that college education doesn't come cheap and by the time a teenager reaches third level, parents are really feeling the pressure of funding their children through university or college.

While accommodation is the biggest financial drain for college students, other costs such as transport and living expenses can quickly add up. There are ways to reduce the financial burden such as limiting the use of public transport, and indeed if a third level student has a part time job, that will certainly help. In fact, 63% of parents said that their child has a job as well as attending college.

Something to think about...

It's clear to see that the cost of education is high and increases over the years. So, wouldn't it make sense to plan ahead and build up your savings year-on-year?

With a Regular Savings plan you can gradually build up the funds necessary to support your children's education.

The table below illustrates just how much regular savings can grow with a Zurich LifeSave Savings Plus plan. For example, if you saved the Government child benefit of €140 per month for five years (as of August 2025) in the Prisma 4 fund from when your child was born, by the time they started school you could have built up savings of €8,954 in time to fund this crucial stage in their education.

| Potential savings fund after five years | Potential savings fund after 12 years | |

|---|---|---|

| Regular contributions of €140 per month* | €8,954 |

€23,605 |

| Lump sum of €10,000 and regular contributions of €140 per month* | €20,119 | €37,040 |

|

A gross investment return of 5.2% per annum is assumed for the 5 year savings fund and 5.5% per annum for the 12 year savings fund. We have assumed that on death, encashment, partial encashment or assignment of the policy or on each 8th policy anniversary, tax is deduced on the gains made at the current rate of taxation, being 41%. A government insurance levy (currently 1% as at August 2025 and may change in the future) applies to this policy. The lump sum contribution amounts above are inclusive of this levy. No surrender penalties apply. An annual management charge of 1.35% and an allocation rate of 101% apply. The information contained herein is based on Zurich Life's understanding of current Revenue practice as of August 2025 and may change in the future. |

||

Cost of education calculators

Our Cost of Secondary School Calculator is a tool that helps you work out how much you need to save to cover the costs of putting children through secondary school.

Cost of Secondary School Calculator

Use our Cost of College Education Calculator to work out the estimated costs of sending your children to college and to see how much you might need to save each month to meet these college costs.